Switzerland is well known for its strong and stable democratic system. Its citizens are more aware of the resulting long-lasting law-making process.

Indeed, the revision of the Swiss inheritance law to enter into force on 1st January 2023 was initiated some 15 years ago. Its main objective was to adapt to the new social realities, notably the apparition of more and more “blended families” or “unregistered” intimate relationships. The result is not groundbreaking, but a prudent compromise as anyone would expect in this country. Before that, the succession legislation did not go through any substantial modification since the adoption of the Swiss Civil Code in the beginning of the 20th century.

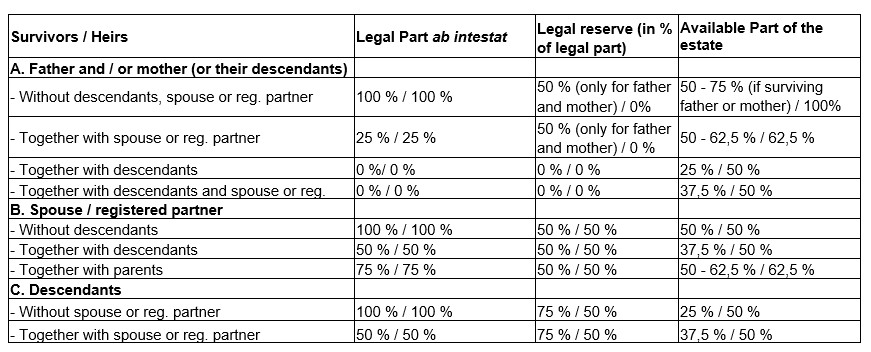

The final draft was accepted by both Chambers of the Parliament in 2020 with a large majority. It will not have any effect in the case of intestate successions. The main outcome is rather the increase of the liberty of the testator, with less restrictive forced heirship provisions. Thus, the intangible right of the parents to receive a minimum share of the estate in the absence of descendants was abolished and the legal reserve in favour of the descendants was reduced to the half of their legal part, instead of % until now. On the other hand, the minimum share in favour of the spouse or registered partner remains the same (50 % or the usufruct of the whole part of their common children).

Legal parts and forced heirship rights before / after the revision

According to the objectives pursued by the revision, the increased rights of the testators to dispose of their assets will allow them to transfer a larger part of their estate to their domestic partners for instance. The propositions to include the non-married or non-registered life companions into the circle of the legal heirs, with or without a forced heirship right, were however purely and simply abandoned. Furthermore, the tax legislation did not really follow the social evolution so far, as the (non-married or non-registered) living partners are still considered as third parties in many cantons for inheritance tax purposes, with the consequence of an inheritance tax rate up to 50 % in some cases...

This being said, the new legislation is broadly welcomed, as it provides more freedom and some useful clarifications. One of the issues addressed in connection with this reform was the transfer of the family business to one of the heirs which, together with an additional revision still under examination, will be possible with fewer difficulties, due to the lower legal reserve of the other heirs and some modified rules about the computation of the value of the enterprise. In parallel, a modification of the Swiss International Private Law following the entry into force of the EU Succession Regulation in 2015 is under examination and will probably be approved soon. This reform, partially in line with the EU Regulation, will especially provide, in addition, more options with regard to the choice of the applicable law or competent court, and the enforcement of foreign decisions should be facilitated. Furthermore, the Swiss courts would be entitled to decline their competence more often in order to avoid positive conflicts of jurisdiction.

Blaise Krähenbühl, 16 November 2022

© 2023 Alliance of Business Lawyers. All rights reserved.